CMA Experts Discuss Polyolefins Outlook for Next Five Years

Photo Credit: CMA by OPIS

A recent webinar held by Houston-based Chemical Market Analytics (CMA) by OPIS (Oil Price Information Services, a Dow Jones company, addressed the challenges faced by the North American polyolefins industry. According to the experts from CMA, one of the most significant challenges faced by polyolefin suppliers may be maintaining economically feasible production rates while simultaneously ensuring a steady product flow to both the domestic and global markets. Among the key takeaways are the following:

▪ Despite the ‘mild economic scenario predicted for the next few years, the North American polyolefins suppliers will have to increase their reliance on export volume growth, particularly for PE, to maintain feasible operating rates.

▪ Thwarting such efforts are some unfavorable factors such as the global economic slowdown forecast for the next two years which is expected to impact global resin demand, while U.S. exports will face stiff competition from expanded local production in several global markets.

▪ However, the North American polyolefins industry may get support to overcome challenges and stay competitive globally due to its abundant, low-cost feedstock advantage, competitive trade infrastructure, and experience in resin production and applications.

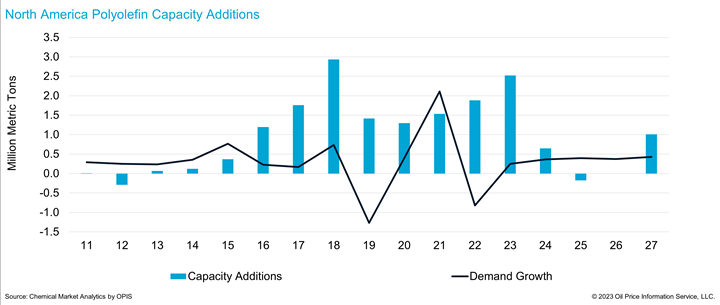

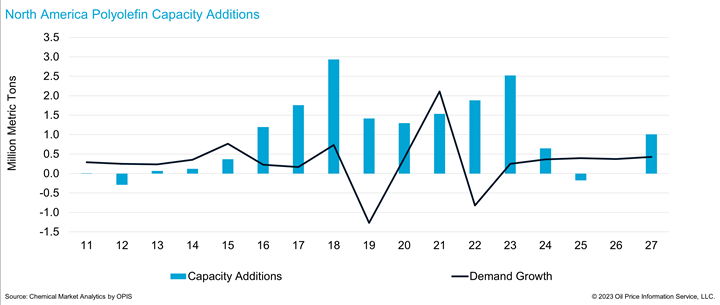

▪ Within the last 12 years, North American polyolefins production capacity saw a significant increase from 63.4 billion lbs to 96.0 billion lbs—a 52% growth. This growth is expected to continue, with the capacity expected to further increase to 102 billion lbs by the end of 2028. Other regions, such as Northeast Asia, the Indian Subcontinent, and the Middle East, have also experienced substantial growth in polyolefins production

capacity.

▪ Domestic polyolefins demand for the North American region grew merely 1.7% in the four years between 2018 and 2022, despite a nearly 8% economic expansion during the same period. Demand in Mexico outpaced growth in the rest of North America, but the overall size of the Mexican economy limits total volume growth. This is due, in part, to the local consumer market becoming increasingly oriented toward

importing low-priced finished plastic goods. Statistics from the US Census Bureau show that the value of select imported plastic finished goods shipped into the United States grew 119% from 2011 to 2022, with Asia and Mexico as the leading suppliers.

▪ In 2022, the North American polyolefins industry relied on exports to partially balance supply and demand, and the rest was addressed by throttling back operating rates across the industry during the last quarter of the year. The CMA pros stress, that most of these exports consist of PE volumes (42%), with a much smaller

portion attributed to PP volumes (5%).

Meanwhile, here are other key projections related to the global economy, recycling, and new technologies:

▪ Global economic slowdown: After the dramatic fall of 2020 and the subsequent rebound in 2021, the global economy has entered what appears to be a period of constrained growth. Global economic growth rates have recently been revised to 3.1% in 2022, 1.5% in 2023, and 2.6% in 2024. Global GDP is not expected to return to 3.4% until 2025. A reduced pace of global economic growth will directly impact polyolefin resin demand.

▪ Increased recycling: As the plastics industry becomes more efficient and develops more durable and resistant plastics, it has also spent significant resources promoting recycling. While advancing circularity goals and pledges, this process will impact demand for virgin resins. The talk and initial stages of plastics recycling have been around for several decades. However, the world has made relatively little progress on the subject, and today, some assumptions indicate that less than 13% of all plastic waste produced worldwide are recycled. With social pressure building, the circular economy will develop both in terms of technology and policy. The plastics industry will have to respond with innovations, more production based on renewables, and a concerted effort to improve collection and recycling technologies. Increased recycling will be another factor keeping a lid on virgin polyolefin resins demand growth in the medium to long term.

▪ New technologies: The plastics industry has invested billions of dollars in providing technical support for their customers and developing more efficient products. In parallel, technological advances may support the development of better tools for designing and creating even more effective and durable products. For instance, the development of super-concentrated laundry detergent has resulted in smaller container sizes. Bottled beverage companies are also developing containers to safely hold liquids using less virgin resin. While new plastics with enhanced durability and longer

product lifecycles support circularity and sustainability

initiatives, they may also reduce the overall demand for virgin resins.

RELATED CONTENT

-

How to Injection Mold Cyclic Olefin Copolymers

This new family of clear engineering thermoplastics made its first big splash in extrusion, but now injection molders are learning how to process these amorphous resins into optical and medical parts.

-

Plastic Pallets Gain Ground In an Eco-Conscious World

Low-cost wood is still king, but plastics’ reusability is a growing attraction among manufacturers looking for sustainable material-handling options. The one major hurdle is today’s high resin prices.

-

The New Look in Plastic — It’s Paper!

Synthetic paper based on filled polyethylene or polypropylene film has been around for decades without causing much excitement–until recently.

Leave a Reply