Global Robotics Market Eyes Return to Growth

Milton Guerry, president of the International Federation of Robotics (IFR; Frankfurt, Germany) reported on 2020’s robotics wave in the association’s online discussion of the global market last year, noting shutdown low points occurred at different times in different locales.

“Order intake and production in the Chinese manufacturing industry began surging in the second quarter of 2020,” Guerry said, “The North American economy started to recover in the second half of 2020, and Europe followed suit a little later.”

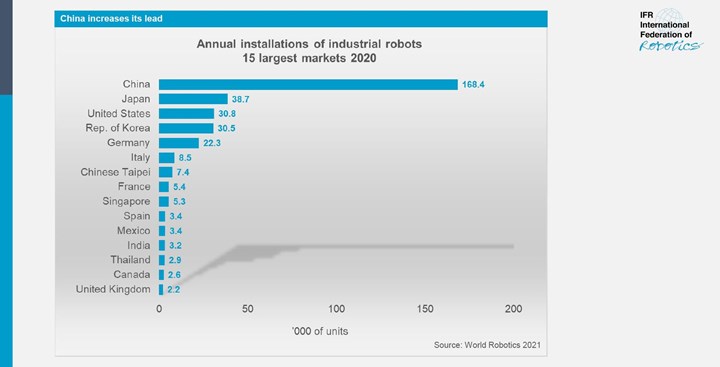

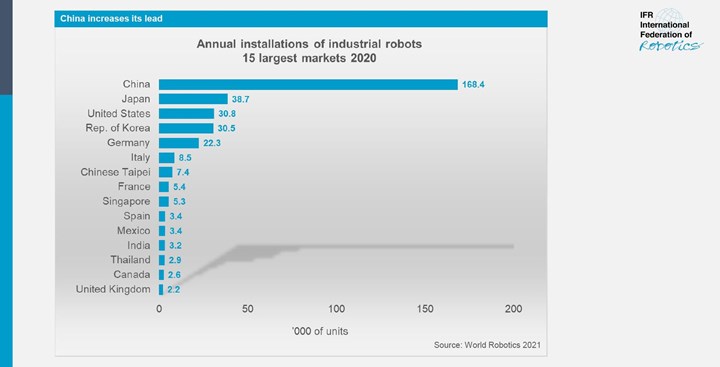

In the end, IFR reported that a record 3 million industrial robots were operating in factories around the world in 2020, an increase of 10%. Overall, new robot sales “grew” 0.5% despite the pandemic, with 384,000 units shipped globally last year. Growth in China helped push worldwide orders higher despite contractions in many markets so that ultimately, IFR says, 2020 was the third most successful year in history for the robotics industry, following only 2018 and 2017.

The year 2018 marked a high water mark for global robotics investments, which contracted in 2019 and were flat in 2020. Starting in 2013, the global robotics market enjoyed six straight years of growth, with the 2018 apex expanding 165% compared to 2012.

IFR predicts that 2021 will see higher figures, forecasting that global robot installations will grow by 13% to 435,000 units, topping that record 2018 year. Installations in North America are expected to increase 17% to almost 43,000 units, while installations in Europe are predicted to grow by 8% to nearly 73,000 units. Robot installations in Asia are expected to exceed the 300,000-unit mark and add 15% to the previous year’s result. Almost all Southeast Asian markets are expected to grow by double-digit rates in 2021.

In a press conference announcing the results, IFR said that for the first time ever on a global scale, installation in the electrical/electronics sector outstripped automotive, with the former growing 23% to 109,000 units, while the latter shrunk 22%. Plastics and chemical installations grew 10% in 2020 to 20,000 globally. Collaborative robots (cobots) have doubled in installations going back to 2017 when 11,000 where installed compared to 22,000 last year. Cobots made up 5.7% of robots installed globally.

The U.S. View

New installations of robots fell in the U.S. by 8% in 2020, marking a second straight year of contraction after eight straight years of growth. The U.S. makes up 79% of North America’s total installations, followed by Mexico (9%) and Canada (7%). Much of the U.S.’s slowdown can be attributed to the automotive sector, where installations fell by 19% to 10,494 units, according to IFR. In contrast, installations in electrical/electronic market were up 7% to 3710 units. Looking forward, IFR says robot installations are forecast to grow by more than 17% in 2021. “A post-crisis boom will create additional growth at low double-digit rates in 2022 and beyond,” the IFR report states.

European Contraction

Europe too saw industrial robot installations fall 8% to 67,700 units in 2020, marking a second straight annual contraction after a 2018 record high of 75,560 units. Here, automotive demand fell by 20% while general industry rose 14%. Germany recorded a 33% share of all European installations, followed by Italy (13%) and France (8%).

Asia Ascendant

Fully 71% of all newly deployed robots were installed in Asia in 2020 up from 67% in 2019. China’s installations rose 20% with 168,400 units shipped. IFR notes this is the highest value ever recorded for a single country. Last year, the number of operating robots in that country reached 943,223 units, growing 21%, with the 1 million-unit mark expected to be topped in 2021. Sales in Japan, meanwhile, declined 23% last year with 38,653 units installed. Here, as in North America and Europe, the country saw a second straight year of decline following a peak (55,240 units) in 2018.

Asian nations made up half of the the top 10 markets for robotics installations in 2020.

Photo Credit: International Federation of Robotics

RELATED CONTENT

-

Robot End-of-Arm Tooling: Making a Big Difference

Often overlooked as a small part of an automation system, clever end-of-arm tooling techniques and designs can improve part quality, heighten efficiency, and eliminate headaches for any molder.

-

INJECTION MOLDING AT NPE: Molding Exhibits Show Off Cell Integration with Multiple Processes & Operations

If you’re interested in lightweight composites, IML, LSR, multi-shot, inmold assembly, barrier coinjection, micromolding, variotherm molding, foams, energy-saving presses, robots, hot runners, and tooling—they’re all here in force.

-

How to Plan and Implement Automation in an Injection Molding Plant

There is no “one size fits all” solution in automation. When considering what it would look like in your plant, hone in on the staff, products, space, and goals that are specific to you and the automation system that you will be installing.

Leave a Reply